Useful Tips on How to Start Your Own Cryptocurrency Exchange

Articles

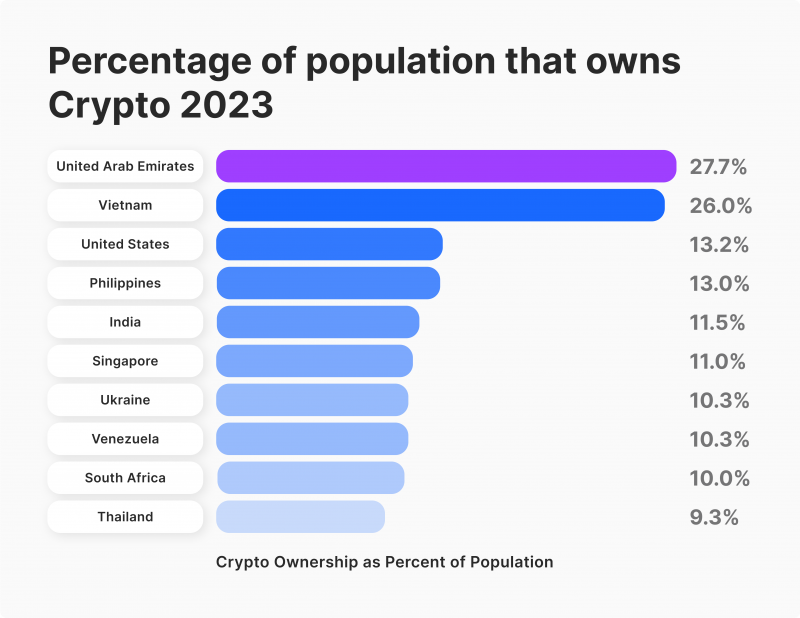

The global crypto exchange market is rapidly expanding due to the growing demand for cryptocurrency and blockchain technology and is expected to reach $4.94 billion by 2030. Being one of the fastest-growing industries globally, the market is gaining interest from investors due to its volatility and potential colossal profit.

This has led to an increase in the number of digital money exchanges being launched and a larger user base. In this article, we will explore how crypto exchanges work and provide you with some tips on how to start your own cryptocurrency exchange.

Key Takeaways

- Crypto exchanges are virtual venues where users can exchange their digital assets for fiat money or other crypto coins.

- There are several types of crypto exchanges, decentralised, centralised, hybrid and peer-to-peer being the most common.

- To start your own cryptocurrency exchange, you can use a white-label solution or develop the platform from scratch.

- To launch your crypto business, you must consider such aspects as target jurisdiction, licensing, security features, partnering with liquidity suppliers and payment processors, etc.

What is Crypto Exchange?

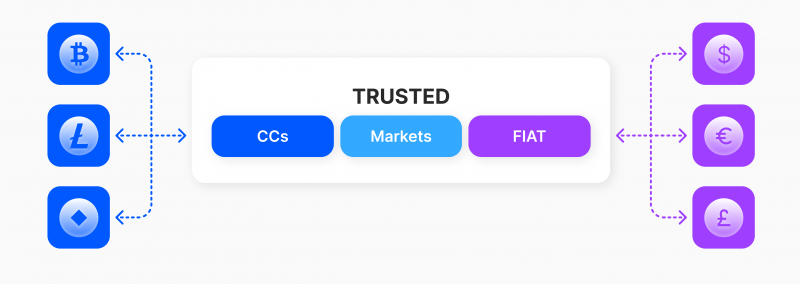

A crypto exchange is a virtual platform where traders can buy or sell digital currencies by converting fiat money into a user’s preferred digital currency. These exchanges offer payment facilities and prioritise security and compliance, which are essential for regular users and businesses.

Crypto exchanges, like stock exchanges, enable investors to buy and sell digital currencies like Bitcoin, Ethereum, or Tether through digital marketplaces like mobile apps or desktop functions. They offer various trading and investing tools, including margin or lending trading and future and options trading.

Fees are a key factor in the profitability of such exchange. They charge fees based on transaction volume or trade type to ensure the smooth functioning of the exchange.

Today, hundreds of worldwide cryptocurrency exchanges offer various digital currencies with varying levels of security and fee structure. Unlike traditional stock or commodity markets, crypto trading generally costs more despite reduced fees in recent years.

Types of Crypto Exchanges

Let’s discover exchange types before learning how to start your own Bitcoin exchange.

Several types of exchanges exist, each offering its advantages and disadvantages. The most widespread are the following.

Centralised Cryptocurrency Exchanges (CEXs)

CEXs act as intermediaries between buyers and sellers, making money via transaction fees and commissions. CEXs operate using an order book system, listing and sorting buy and sell orders by the intended price.

The matching engine connects purchasers and merchants based on the best executable price given the required lot size. Whether a digital asset is a crypto or fiat currency, its price is determined by supply and demand. CEXs decide which digital assets they allow trading, providing some comfort that unscrupulous assets may be excluded.

Popular centralised exchanges include Binance, Kraken, and Coinbase Exchange.

Decentralised Crypto Exchanges (DEXs)

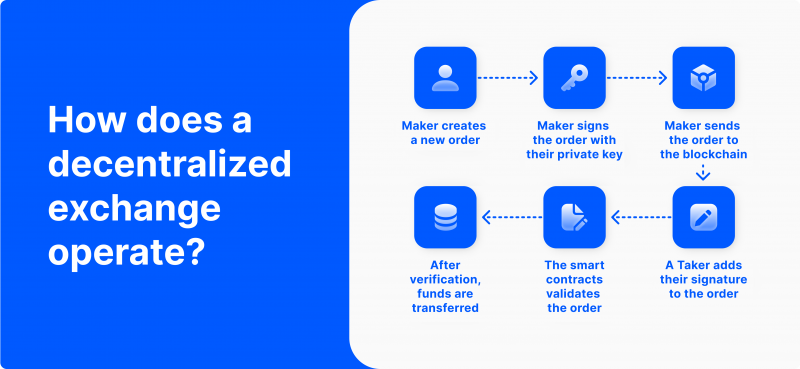

DEXs are autonomous trading platforms that operate without a central authority. They are built on public distributed ledger infrastructure like the Ethereum network, allowing users to trade digital assets without losing control of their private keys.

DEXs enable peer-to-peer transactions directly from digital wallets without intermediaries since trades are executed based on predefined conditions, eliminating the need for mediation.

These exchanges use smart contracts on a blockchain for increased privacy and reduced transaction costs. Despite being rules-based, DEXs are primarily designed for sophisticated investors because they lack an intermediary third party, leaving users to make their own decisions.

Crypto exchanges are popular for storing and exchanging fiat and digital assets, but they can be extremely risky, and users often find their assets locked up in bankruptcy proceedings. Exchanges are often targets of hackers due to the large amount of currency in their custody.

In 2014, hackers stole hundreds of millions of dollars from Mt. Gox, the world’s largest exchange. Unlike brokers and bankers, DEXs are not registered and regulated by state or federal authorities, leaving consumers with limited access to information about their safety and the protection of their assets.

Examples of DEXs include Uniswap, PancakeSwap, dYdX, and Kyber.

Hybrid Crypto Exchanges

A hybrid exchange platform combines the benefits of both CEX and DEX, with transaction history stored on the blockchain for security and a centralised server for processing more transactions.

Hybrid exchanges offer user control over funds, eliminating the need for custodians and allowing traders to engage directly with digital assets in their wallets. These exchanges are decentralised, ensuring personal information protection and privacy.

Hybrid exchanges borrow from centralised counterparts, offering user-friendly interfaces, customer support, and better liquidity. Overall, hybrid exchanges represent the next generation of crypto trading marketplaces.

Examples of hybrid exchanges are Qurrex and Eidoo.

Peer-to-Peer Crypto Exchanges (P2P)

P2P exchanges provide direct transactions between users without intermediaries, using an escrow service to ensure transactions are completed at an agreed price and payment method.

P2Ps offer advantages such as a simple buying and selling option, no buyer fees, and user protection through seller ratings. However, they come with flaws, like potential exchange delays, the risk of sending money to the wrong user, and difficulty resolving charges after transactions.

P2Ps are widespread in Africa and countries where Bitcoin exchanges are banned. Platforms like LocalBitcoins and Paxful are good examples.

White Label Vs On-Premise

When deciding how to open a crypto exchange, you face the dilemma: develop an exchange from scratch or purchase a white-label product. Let’s take a closer look at the benefits and drawbacks of both options to help you pick how to start your own cryptocurrency exchange.

White Label Exchange Software

White-label crypto platform solutions are a simple and cost-effective way to start your own crypto exchange business. Registering and paying deployment fees allows you to access off-the-shelf crypto exchange software with your company logo. Technical service providers manage the platform software and are responsible for maintaining it and fixing any issues.

White-label software offers several advantages, including confidence, cost savings, and faster time to market. It has likely been tested in the marketplace, ensuring smooth operation and timely support.

Outsourced services are more cost-effective than developing full-featured functionality from scratch. Some solutions allow one to quickly start a crypto exchange platform, allowing for more testing and revenue generation.

However, white-label platforms often integrate third-party services, limiting your autonomy to use other services. You are also bound by their pricing structure, making it challenging to find the best deal on any particular service.

Another downside to white-label platforms is that you do not own the software, which can prevent access to crypto marketplaces in jurisdictions that require ownership.

White-label packages are less time-consuming and can be cheaper than full-time software management. However, you lack control and cannot directly impact its performance. Scaling up is also affected, as you are restricted by what is available and may not be able to achieve your desired developments.

On-Premises Development

On-premise crypto exchange platforms offer both control and responsibility. You can develop your own Bitcoin exchange website and amend, add, or remove features as you wish, with the ability to integrate features or services on a whim. However, you are also responsible for managing and maintaining the software.

In an in-house development scenario, you have team members within your company who can quickly resolve any issues, as they have a better understanding of your project requirements as they work under the same roof.

In-house development offers more technical independence and maintains critical competencies, allowing the core team to provide technical support and sustain the product over time. This approach saves time and money in product maintenance and support, as the same team handles the product after release.

Additionally, in-house development provides better control over the process, as the entire work process is handled by the company’s workforce, allowing for more supervision over staff and the development process. This results in real-time professional feedback, allowing for more timely and effective project handling.

One key benefit of on-premise crypto exchange platforms is quickly adapting and moulding the software platform to suit your needs.

However, if you are on a limited budget, you may struggle to hire and establish development staff due to high costs, including expansion, tech setup, and software installation. Additionally, you may lack the latest tech stack and expertise, leading to missed opportunities.

Also, time is a significant factor, as you might spend months or years searching for qualified personnel, especially in the blockchain field, which requires a substantial investment in time and resources.

As of November 2023, there are 228 spot exchanges in the market with a total daily volume of almost $247.88 billion, according to CoinMarketCap.

Things to Consider to Start Your Own Cryptocurrency Exchange

Now that you know the basic concepts of crypto exchanges, their types and how they work, you may want to start your own Bitcoin exchange and gain considerable profit from it. However, this is a challenging task, and we’d like to provide you with guidelines to make launching your exchange easier.

Here are steps you should consider before starting your crypto business.

Define Your Target Jurisdiction

When choosing a jurisdiction for a crypto exchange platform, it’s crucial to study all legal aspects related to licensing thoroughly. A license is necessary for exchange operations and cooperation with payment systems and banks.

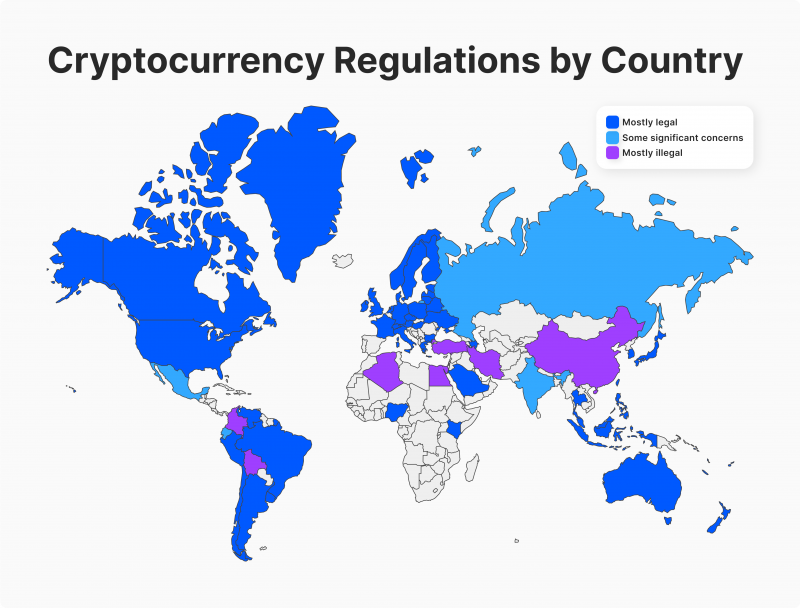

Some countries prohibit crypto transactions, so choosing crypto-friendly jurisdictions is essential. Factors to consider include the state’s attitude towards cryptocurrencies, infrastructure development, peculiarities of corporate legislation, market openness, political and economic stability, service costs, authorised capital requirements, and terms of cryptocurrency business registration.

Avoid countries that prohibit cryptocurrency transactions and instead consider crypto-friendly jurisdictions.

Secure Initial Funding

To create a cryptocurrency exchange, you need to invest in hiring a professional team, including developers, testers, marketers, lawyers, and content creators. The exact sum depends on your business goals and opportunities.

However, estimating the amount should include expenses on hiring professionals, obtaining licenses, implementing security features, and marketing your trading platform. Therefore, planning your budget for creation and maintenance is crucial.

Ensure Legal Compliance

Before opening a cryptocurrency exchange business, it’s crucial to understand the regulatory requirements. Proper licensing is necessary in all jurisdictions where the company plans to operate. In some countries, crypto exchanges operate without significant oversight, while in others, like the US, Bitcoin operators must be licensed and follow SEC and CFTC rules.

Legal counsel is essential, as exchanges must adhere to KYC regulations, which have become increasingly prevalent to combat money laundering.

Regulations vary by jurisdiction, so consulting with an attorney familiar with the industry is essential.

Implement Best Security Practices

Digital money requires protection and security, as nearly half of cryptocurrency exchange businesses have closed due to hacking. Crypto exchange owners must constantly implement and improve security measures, such as two-factor authentication, cold and hot wallet usage, database encryption, anti-phishing features, and other up-to-date technologies, to maintain the required level of security.

It’s crucial to ensure your website is a secure platform for transactions and withdrawals and that your client’s sensitive personal information is protected.

Build The Architecture

The exchange website’s basic architecture should consist of four essential steps:

Trading engine – The trading engine should have unrestricted access to the order book, match all orders, process transactions, and calculate balances.

Front end – The front end should be user-friendly and intuitive for clients to find their accounts, see exchange rate changes, deposit crypto or fiat money, and place orders.

Wallet – The wallet should enable secure withdrawals and conversions of virtual money to fiat currency.

Admin panel – The admin panel should help manage trading operations, verify processes, create liquidity, and provide professional customer support.

Partner With a Payment Processor

The payment processor facilitates crypto deposit and withdrawal, requiring careful consideration of its performance, transaction speed, security, availability, and listing of cryptos. It’s essential to research the number of companies using this payment system, market prices, conditions, and feedback before deciding.

Find a Reliable Liquidity Provider

Liquidity is crucial for the success and competitiveness of your exchange business. Find a reliable liquidity provider with an extensive network of existing exchanges in the cryptocurrency market.

Consider factors like market depth, order execution speed, price spread, legality, software, customer support, and compliance with regulations like anti-money laundering.

Test Your Platform

The testing process is crucial for the development of a crypto exchange. It involves various procedures such as vulnerability testing, KYC verification, deposit and withdrawal testing, purchase and sale testing, registration process testing, and API and WebSocket testing.

Identifying vulnerabilities and problems in the crypto exchange’s logic is essential to protect customer data and assets and ensure seamless transactions. It’s also important to collect user feedback and make necessary improvements to enhance the user experience and performance.

Start Marketing Campaign

Before launching, it is crucial to promote it to the target audience. This can be achieved through various marketing strategies, such as social media marketing, influencer marketing, partnerships with crypto-related services and communities, and PR.

Social media platforms like Facebook, Instagram, or Reddit can be used to create a community of potential users and support existing customers, while PR efforts should focus on building relationships with the media, publishing press releases, giving interviews, and sharing insights into the crypto sphere.

After launching the platform, gathering user feedback is essential to understand the audience’s experience and preferences, which will aid in further platform development and support.

Ensure Customer Support

A booming crypto exchange relies heavily on customer support, which is crucial for long-term success. To address customer complaints and technical issues, you should implement ticketing systems and staff them with knowledgeable representatives who are available 24/7. This approach ensures timely responses and a seamless experience for all users.

Benefits of Running a Digital Exchange

Starting your own cryptocurrency exchange can be a challenging but rewarding campaign, allowing you to influence the success of your business for years to come. Here are some of the many benefits that your crypto business may bring you.

High demand – The global demand for cryptos is on the rise, with investors believing they have the potential to grow further over time. This trend is expected to continue, indicating a high demand for these digital assets and their potential for continued growth and prosperity.

High profitability – Cryptos are traded 24/7, 365 days a year, providing profit opportunities. Exchanges act as intermediaries between buyers and sellers, making significant profits from trading fees charged on every user transaction.

Wide range of business opportunities – Cryptos are gaining popularity among investors, leading businesses to offer them as payment options for goods and services on their websites. Merchants rely on third parties like exchanges to process transactions, increasing demand for exchange platforms as more users use cryptos for online purchases.

High ROI – Crypto exchanges are in high demand, providing businesses with a high return on investment and liquidity. Popularity among users leads to increased volume and demand, creating more opportunities for profit-making. The industry is expected to continue expanding, making it a promising business for growth.

Scalability potential – A developer can quickly scale up an exchange platform, starting with a few users and expanding into a large-scale business offering thousands of features and services. As the business grows, new features can be added to cater to different niches like mining, making it a flexible and adaptable option for developers.

Bottom Line

The crypto exchange industry continues to evolve despite fluctuations in exchange rates, the pandemic, and other challenges. New players constantly emerge, creating modern exchange platforms with cutting-edge features, trading instruments, and crypto pairs. In this highly competitive environment, starting your own cryptocurrency exchange might be difficult.

However, this endeavour might be very rewarding, and the success depends on constant innovation, user-centric design, and understanding your users’ needs. To ensure customer satisfaction, the exchange should meet their expectations of high security, transparency, wide coin choice, high liquidity, and exceptional customer support.

FAQ

What features are included in a white-label exchange?

White-label exchange platforms typically include a trading engine, a user interface, wallet integration, safety precautions, KYC/AML compliance, and customer support.

How much does it cost to make a cryptocurrency exchange?

Building a cryptocurrency exchange costs between $200,000 and $600,000, but this estimate may vary based on specific requirements, desired customisation levels, business needs and factors like development time and technology used.

Do crypto exchanges charge fees from their users?

Crypto exchanges typically charge fees for placing trades, including fund transfers, maker/taker fees, and transaction fees based on trading volume.

How to open a crypto exchange without obtaining a license?

Crypto marketplaces require various licenses and regulations in most countries, including registration with FINRA or SEC, foreign financial regulators, and tax filing requirements.

Seeking answers or advice?

Share your queries in the form for personalized assistance